- Travis County Tax Office Calculator: The most reliable option with real-time data from official county records. Perfect for precise, government-verified estimates.

- SmartAsset Property Tax Calculator: Great for quick estimates, factoring in homestead exemptions and specific Austin school districts.

- Redfin Tax Estimator: Combines local tax data and recent sales for neighborhood comparisons, with an easy-to-use interface.

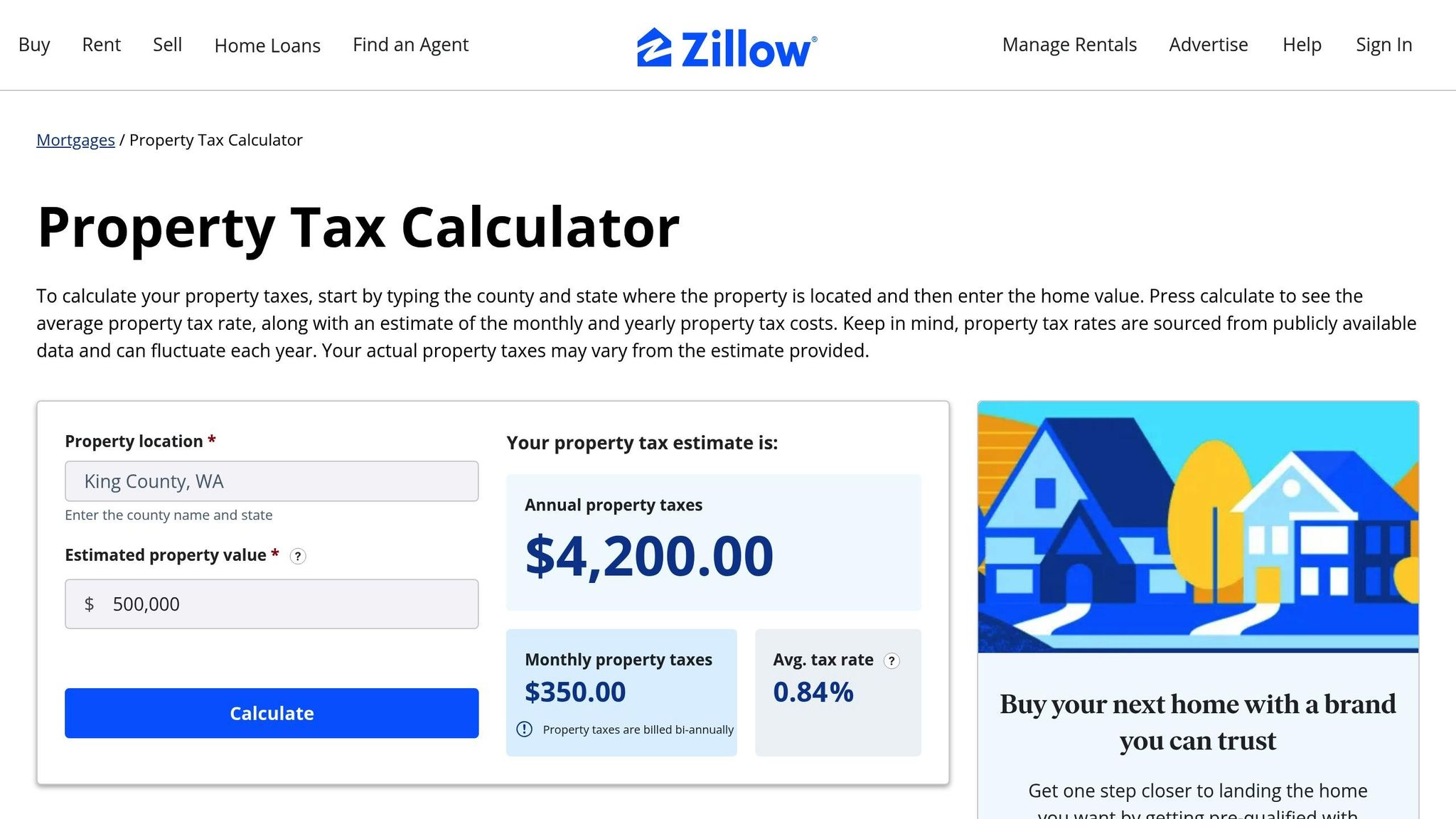

- Zillow Tax Calculator: Uses Zestimate values and Travis County rates for estimates, ideal for home shopping.

- Tax-Rates.org Calculator: Offers statewide tax rate tables for general estimates but lacks property-specific details.

Quick Comparison

| Calculator | Data Source | Updates Frequency | Exemptions Included | Best For |

|---|---|---|---|---|

| Travis County Tax Office | Official TCAD records | Real-time | Yes | Accurate, official estimates |

| SmartAsset | Public records | Annual | Yes | Quick, location-based estimates |

| Redfin | TCAD + Sales data | Monthly | Yes | Neighborhood comparisons |

| Zillow | Zestimate + County rates | Monthly | Yes | Home shopping projections |

| Tax-Rates.org | Statewide tax tables | Annual | No | General estimates |

For the most accurate estimates, use the Travis County Tax Office Calculator. For quick comparisons or home-shopping insights, tools like Redfin or Zillow are helpful. Always cross-check with official sources to ensure accuracy.

How Much Are Property Taxes in Austin? – CountyOffice.org

1. SmartAsset Property Tax Calculator

SmartAsset’s calculator uses Travis County assessment data and tax rates, updated each year to align with local changes. Users can enter details for specific Austin school districts, and the tool automatically factors in applicable homestead exemptions based on the property’s location. It’s a handy way to get quick estimates for most neighborhoods in Austin. However, it may not always reflect the latest information for newer developments or recently annexed areas.

For official estimates directly from the county, check out the Travis County Tax Office Calculator next.

2. Travis County Tax Office Calculator

The Travis County Tax Office Calculator is your go-to tool for official property tax estimates. It pulls real-time data straight from TCAD’s assessment records and current tax rates, ensuring accurate, government-verified numbers for properties in Travis County.

What it offers:

- Real-time tax rate updates

- Homestead exemption calculations

- Detailed precinct-level breakdowns

- PDF export options

- Full mobile compatibility

Simply enter your address to access official rates and generate personalized reports tailored to your property’s location and exemptions.

Advantages:

- Direct access to county data – no third-party fees

- Accurate tax details down to the precinct level

Drawbacks:

- Limited customization features

- Lacks data for neighborhood comparisons

- Basic, no-frills interface

Next, we’ll explore how Tax-Rates.org’s calculator stacks up as an alternative.

3. Tax-Rates.org Calculator

Tax-Rates.org provides statewide property tax rate tables instead of focusing on property-specific assessments like the official Travis County calculator. Its property tax calculator uses the latest Texas tax rates sourced directly from state tax authorities. These rates are broken down by jurisdiction, giving a broader view of property tax rates across Texas.

However, the calculator doesn’t include features like address-based lookups or local exemptions, which means it can only offer general estimates rather than precise tax liabilities for individual properties in Austin.

sbb-itb-4c99469

4. Redfin Tax Estimator

Redfin’s tax estimator combines data from statewide and county sources with recent sales and local tax information to provide detailed property tax projections. It uses assessments from TCAD (Travis Central Appraisal District) and nearby sales data, updating monthly to stay in line with market trends. The tool also incorporates Austin-specific tax rates and exemptions, delivering property-specific estimates.

Key Features:

- Search properties by address, complete with sales history

- Automatically calculates homestead and senior exemptions

- Offers downloadable reports in PDF and CSV formats

- Compares tax assessments of nearby properties

- Works seamlessly on mobile devices and tablets

Advantages:

- Includes recent sales data for better market context

- Automatically identifies applicable exemptions

- Easy-to-use interface with visual charts

- Free to use without requiring registration

Limitations:

- Does not provide tax breakdowns at the precinct level

- Monthly updates may lag behind TCAD’s latest changes

- Limited access to historical tax rate data

For Austin homeowners, this tool is a helpful option for budgeting or filing appeals. It bridges the gap between official county data and general tax rate tables, making it particularly useful for comparing tax assessments of similar properties in the same neighborhood.

Next, we’ll look at Zillow’s Tax Calculator and see how it stacks up.

5. Zillow Tax Calculator

Zillow’s Tax Calculator uses Travis County tax rates and Zillow Zestimate values to estimate property taxes for homes in Austin. You can search for properties by address and adjust the estimates to reflect exemptions or assessment changes.

Key Features:

- Uses Zillow Zestimate data for market value estimates

- Displays tax history with charts showing payment trends

- Includes homestead and senior exemption calculators

- Lets you compare taxes with nearby properties

- Updates monthly based on local market changes

Pros:

- Works seamlessly with property value estimates

- Easy-to-use interface with interactive charts

- Automatically applies eligible Travis County exemptions

Cons:

- Updates might not reflect the latest TCAD changes

- Doesn’t provide precinct-level tax rate details

- Estimates based on Zestimate values may not match TCAD assessments

Next, we’ll look at a side-by-side comparison of all five calculators to help you decide which one works best for your Austin property.

Calculator Features Comparison

Calculators vary based on their data sources, how often they update, and how they handle exemptions. For example, the Travis County Tax Office tool connects directly to TCAD, providing real-time estimates straight from official records. On the other hand, third-party tools like SmartAsset, Tax-Rates.org, Redfin, and Zillow rely on public records and MLS data. These tools are handy for neighborhood comparisons and spotting trends, but they update less frequently and differ in how they manage exemptions.

This breakdown helps you weigh your options and pick the right tool. Use it as a guide before checking out our tailored recommendations.

Summary and Recommendations

Pick the right tool for your needs:

- Official records: Use the Travis County Tax Office Calculator for data pulled directly from county records.

- Neighborhood comparisons: SmartAsset’s tool helps you see how location impacts your property tax bill.

- Home-shopping projections: Zillow or Redfin provide quick estimates while browsing homes.

- Quick estimates: Tax-Rates.org offers simple calculations without additional features.

Keep in mind, third-party tools rely on public data and may not reflect the most recent updates. For the most accurate information, double-check with the Travis County Tax Office.

If you’re looking for personalized property tax advice or market insights, reach out to the local experts at Austin Local Team.