Here’s what you need to know about Austin Real Estate today:

-

- Austin’s housing blueprint hits halfway mark, misses affordable units target 🏠

- Zillow reports first Texas home value drop since 2011 💸

- Texas leads U.S. in 2023 bond sales, fueling infrastructure growth 🌉

- Houseboats trend as cheaper living alternatives in pricey Central Texas ⚓

Real Estate Market Trends and Developments in Texas

Scorecard: Where Austin falls short, is making progress on its 10-year housing plan

Source: KXAN News

Summary: Austin’s 2022 Strategic Housing Blueprint Scorecard reveals mixed results at its halfway point, with successes in creating new housing near planned centers and preserving affordable units. However, a significant shortfall exists in the goal for creating 60,000 new affordable units in a decade, particularly for households earning 30% median family income or below. The city is considering changes to the blueprint that could include a focus on City-funded units and a possible overhaul funded partially by a $10 million HUD grant.

Why this matters: Understanding the city’s struggles and successes in housing development allows real estate professionals to make informed decisions when advising clients on property investments or development opportunities, particularly in underserved areas.

Home values in Texas dropped this year for the first time since 2011, Zillow data shows

Source: Central Texas Real Estate Journal

Summary: Central Texas is currently experiencing a significant surge in real estate demands, both commercial and residential, largely driven by an influx of tech companies and remote workers moving to the area. This boom has led to increased property values, making it an ideal market for sellers. However, with the increased demand and limited supply, there is a strain on affordable housing options, making it tougher for first-time buyers or those with a limited budget. Additionally, new regulations and zoning laws could potentially impact future development. Stakeholders, therefore, need to stay vigilant and adaptable to these changing market dynamics.

Why this matters: For those in the real estate industry, this trend of increased demand and limited supply presents both opportunities and challenges. By staying informed about the shifts in the market, realtors can better anticipate their clients’ needs and adjust their strategies accordingly, whether that means targeting tech workers for high-end properties or advocating for more affordable housing options.

Is a houseboat more affordable than apartment rent? Tracking rent prices in Central Texas

Source: The Eagle

Summary: The article discusses an upward trend in interest towards houseboat living as a cheaper alternative to traditional apartment rentals. Searches on Google for “”how to live on a boat”” have risen by 71% in the past year and the topic has garnered 7 billion views on TikTok. Reports from Thrillist and Rightboat indicate that the costs of boat slip rental and houseboat ownership are significantly less than apartment rentals, particularly in major cities with high rental rates and limited available housing. This shift in housing preference could have implications on rental prices and the overall real estate market in Central Texas.

Why this matters: Given the increasing interest in houseboat living, real estate professionals in Central Texas may want to familiarize themselves with this niche market to address potential shifts in consumer housing preferences and deliver innovative solutions to their clients.

New home sales nationwide plunged in November. Here’s where home sales are headed in Texas

Source: The Eagle

Summary: November witnessed a plunge in new home sales across the United States, attributed primarily to the highest mortgage rates seen in 23 years. The sales of newly constructed homes fell by 12.2% to a seasonally adjusted annual rate of 590,000 from a rate of 672,000 in October, even though mortgage rates have started to retreat from their peak. Affordability issues arising from these high mortgage rates have been a major deterrent for potential homebuyers. For instance, a family would require an income of close to $130,000 to afford a median-priced new home in the U.S. at the current interest rate of 6.5%. The article also includes a link to charts indicating the trend of home sales in Texas.

Why this matters: Understanding the impact of fluctuating mortgage rates on the real estate market is critical for real estate professionals in Central Texas to provide accurate advice to their clients and make informed decisions about their own property investments or sales strategies.

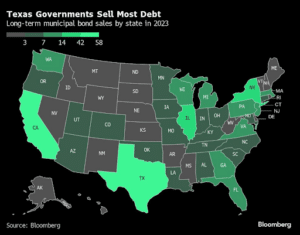

Texas Tops US States in 2023 Debt Sales With No Signs of Slowing

Source: Bloomberg L.P.

Summary: Texas is leading US states in debt sales, issuing $58 billion of bonds in 2023 to fund diverse projects like school construction, water utility projects, and airport enhancements, driven by the state’s population growth. This is the first time since 1990 that Texas has surpassed New York and California in municipal bond sales. The significant population increase, spurred by lower living costs and a business-friendly environment, has necessitated readiness for infrastructure projects to maintain pace with the population. However, Texas’ municipal market has faced challenges due to state laws targeting Wall Street banks’ policies on firearms and fossil fuels. Despite these challenges, infrastructure spending will continue to be a big item for

Texas governments in the near future, with nearly $60 billion of school district bonds approved by voters in the last two years.

Why this matters: This heightened infrastructure spending in Texas presents a significant opportunity for real estate professionals to capitalize on the population growth and increased demand for both residential and commercial properties. It is essential for them to stay informed about these market developments to identify potential investment opportunities and provide well-informed advice to their clients.

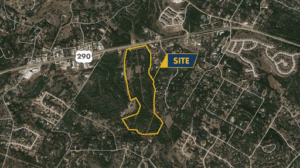

JLL Arranges Construction Financing for 338-Unit Multifamily Project in East Austin

Source: REBusinessOnline

Summary: JLL has arranged construction financing for a new 338-unit multifamily project in East Austin, named Lirica East Austin, with completion projected in early 2026. The project is a partnership between CSW Development and Blueprint Local and will feature various amenities such as a pool, clubroom, fitness center, coworking space, and sky lounge.

Why this matters: This article emphasizes the growing investment opportunities in East Austin, indicating a potential hotspot for real estate professionals and their clients.

Endeavor Real Estate Group Plans $42 Million Austin, Texas, Multifamily Project

Source: CoStar

Summary: Endeavor Real Estate Group is planning a $42 million multifamily project in Austin, Texas, indicative of the growing demand for residential properties in the area. As Austin continues to experience a population surge, there is an ever-increasing need for more housing options, making such projects inevitable and beneficial for the local real estate environment.

Why this matters: The upcoming Endeavor project underscores the buoyancy of Austin’s real estate market, highlighting potential investment opportunities for clients and informing real estate professionals on market trends.

Fantasy Farm Friday: 137 Acres in the Lone Star State

Source: HorseNation.com

Summary: This article highlights a 137-acre, equestrian-oriented property named Long Road Ranch up for sale in Williamson County, Central Texas. The expansive, $5.9 million property offers various features that cater to equine enthusiasts and outdoor lovers, including multiple barns, four ponds linked directly to the San Gabriel River, and a full trap and skeet range. The main house, spanning approximately 2,930 sq. ft., has three bedrooms and 3.5 bathrooms. The property also provides significant outdoor living and entertainment opportunities, including a pool, hot tub, fire ring, outdoor kitchen, and beautiful patios.

Why this matters: Real estate professionals focusing on farm and ranch properties in Central Texas can leverage this information to inform potential clients about the availability of high-end, equestrian-oriented properties in the area, showcasing the range and diversity of the Central Texas real estate market.

Texas homeowners perplexed as to whether new law applies to their HOAs: ‘They wrote the law with zero foresight’

Source: Yahoo Lifestyle

Summary: The recently passed HJR 126 amendment to the Texas state constitution has caused confusion among homeowners, particularly those belonging to Homeowners Associations (HOAs). While the amendment is designed to protect rights to engage in farming and related activities on a person’s own or leased real estate property, it’s unclear how it interacts with existing HOA rules and regulations, resulting in uncertainty and debate among homeowners. The amendment’s potential impacts could change the dynamics of residential real estate, especially in areas with HOAs.

Why this matters: This article is a crucial read for real estate professionals as it highlights an ongoing issue that could affect property management and homeowner decision-making – understanding the implications of this new amendment could provide a competitive edge in advising clients and navigating property sales within HOAs.

Population Trends and Migration Patterns in Texas

Red states like Texas and Florida see population boom – while migrant crisis offsets loss in ‘sanctuary city’ states, like New York, California and Illinois as residents flee due to crime and high tax rates

Source: Daily Mail

Summary: The census data reveals a significant population surge in red states like Texas and Florida, with Texas seeing the largest increase nationwide between July 2022 and July 2023. The growth, which is mainly attributed to the region’s migration patterns, saw around 706,266 people added via net domestic migration, while net international migration contributed almost 500,000. Meanwhile, states like New York, California, and Illinois witnessed population declines, offset to some extent by the influx of migrants. South Carolina led the states in population growth rate, followed by Florida and Texas. The report also indicates a steady rise in immigration to the U.S., powering the nation’s overall population growth.

Why this matters: The significant population growth in Texas, especially around Austin, presents a substantial opportunity for real estate companies to capitalize on the increased demand for residential, commercial, and land/farm real estate properties. Stay ahead of this demographic trend to offer your clients insights into prospective growth areas.

Commercial and Retail Industry Developments in Texas

The great frozen treat land rush unfolding in Austin

Source: The Real Deal

Summary: Austin, Texas, is witnessing a surge in the frozen treats industry as two New York-based companies, Abbott’s Frozen Custard and 16 Handles, plan aggressive expansions. Abbott’s, with 36 locations across six states, plans to double its store count through Texas expansion alone, starting with Kyle and eyeing Leander and Manor. It expects to open at least 10 shops in the Austin area in four to five years. Similarly, 16 Handles is eyeing seven to 10 openings in Austin in the next three years, with one store already under development in Northwest Austin. Both companies are looking to franchise and are targeting built-out areas with nighttime traffic, near restaurants, and retail centers.

Why this matters: The inflow of these popular frozen treat companies into Central Texas signals a robust and growing retail market, offering real estate professionals opportunities to assist in securing desirable locations and potentially benefitting from increased commercial property demand in the area.