Here’s what you need to know about Austin Real Estate today:

- Austin’s HOME Act: A game-changer for housing affordability. 🏡

- Austin’s housing boom: Over 90,000 new units redefine living spaces. 🌆

- East Austin’s $1.5M real estate deal fuels vital wastewater project. 💧

- Disrupt Equity’s big move: Snags 673-unit Texas property portfolio. 🏢

Housing Development and Affordability in Austin

Opinion: The HOME Act Will Help Keep Austin Affordable and the American Dream Alive

Source: Austin Chronicle

Article Summary: The opinion piece underscores the housing affordability issue in Austin, pointing out that an annual income of $180,000 is needed to afford a median-priced home. The author lauds the proposed HOME Act by Austin City Council Member Leslie Pool, which would allow for up to three housing units on a single residential lot – a potential measure to increase affordability and accessibility for the city’s diverse population. The author shares a personal connection to the American dream, underscoring the importance of affordable homeownership for the growth and vibrancy of the city.

Key Takeaways: Real estate professionals in Austin can use this understanding of the HOME Act and the broader housing affordability crisis to more effectively cater to their clients’ needs, and potentially identify new avenues for investment in the city’s housing market.

Austin’s Housing Landscape Undergoes Unprecedented Transformation

Source: City of Austin Planning Department’s Demography Division

Article Summary: Over the last decade, Austin has seen an exceptional boom in its housing landscape with the addition of over 90,000 housing units, surpassing most U.S. major cities. Despite this, the city’s rate of unit production has slowed when compared to the 2000-2010 period. The city’s contribution to the region’s overall housing has remained stable while the metro area has grown faster, causing Austin’s share to dwindle. The city’s housing stock has also seen a shift towards more rental units. Austin has led large U.S. cities in terms of household growth, which has outpaced the city’s total housing unit and population growth between 2010 and 2020.

Key Takeaways: This information can be vital for readers looking to understand Austin’s housing landscape, helping them make informed decisions about buying, selling, or investing in residential properties in a market that is increasingly leaning towards rental units.

Leifer makes strides on gentrifying St. Elmo district in Austin

Source: The Real Deal

Article Summary: Leifer Properties, a Connecticut-based firm, is advancing its development plan for a mixed-use project in South Austin’s St. Elmo neighborhood. The firm is seeking rezoning approval to transform a 4.3-acre site into creative office space, residences, and retail outlets. If the rezoning is approved, the maximum building height could increase from 85 to 125 feet, and the number of dwelling units could rise from 400 to 600. This project is part of a larger plan, with Leifer owning a total of 11 acres in the neighborhood. The proposed development further underlines the ongoing evolution of the St. Elmo neighborhood.

Key Takeaways: The development plans of Leifer Properties in the St. Elmo neighborhood provide a unique perspective on potential growth opportunities for local businesses and real estate professionals in South Austin.

Urban Development and Real Estate Transactions

Cap Metro settles with city on East Austin real estate deal that paves the way for wastewater project

Source: The Austin Monitor

Article Summary: The Capital Metropolitan Transportation Authority has approved the sale of a portion of land in East Austin to the city of Austin. This real estate deal paves the way for a wastewater project, the Walnut Interceptor Odor and Corrosion Improvements capital project. The city will construct an odor control facility to rectify odor and corrosion issues plaguing the Walnut and Little Walnut wastewater basins. The project, which is expected to begin in 2024 and conclude in 2025, sees Austin paying Capital Metro $1,499,673 for the 1.385 acres of land.

Key Takeaway: The relevance of this report to central Texas real estate professionals lies in the public sector’s role in shaping future land use and development opportunities, specifically the sale of land for infrastructure improvements, which may affect surrounding property values and potential development opportunities.

Disrupt Equity Acquires 3-Property Portfolio in Texas

Source: Multi-Housing News

Article Summary: Disrupt Equity, in partnership with Open Door Capital, has expanded its multifamily property portfolio in the Austin and Houston areas with the acquisition of a three-property ensemble totaling 673 units. The properties were purchased from Nitya Capital and the transaction was completed via a CMBS loan assumption. The properties, situated in Austin’s East Riverside Corridor, Stafford, and Katy, Texas, boast strong rent growth and high absorption rates, making them lucrative investments for the Houston-based firm.

Key Takeaway: As commercial real estate professionals, understanding the significance of locations with strong rent growth and high absorption rates, such as those in the acquired portfolio, can guide strategic investment decisions and provide valuable insights to clients looking to invest in multifamily properties.

Austin’s General Livability and Festivity

Austin sparkles and shines as the No. 1 most festive city in the U.S. for 2023

Source: Thumbtack Reports

Article Summary: Austin, Texas shines as the most festive city in the United States for 2023, according to two reports. This accolade is based on the number of Christmas-related home projects and the festive displays that adorn the city such as the Trail of Lights, Community First! Village of Lights, and Mozart’s Annual Holiday Light Show. Texas cities dominated the top spots with Dallas-Fort Worth and Houston ranking at No. 2 and No. 3 respectively. Residents looking to hire a holiday lighting specialist can expect to pay between $168-$300, with the last week of November being peak time.

Key Takeaway: Austin’s title as the leading festive city indicates a vibrant community spirit that can influence both residential and commercial real estate decisions. This community engagement could be a significant selling point for potential homeowners or businesses considering relocation.

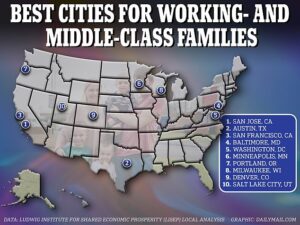

America’s most expensive cities ARE worth the money: San Jose, Austin, and EVEN crime-ridden San Francisco offer best quality of life thanks to high wages, study shows

Source: DailyMail.Com

Article Summary: Austin is included among the top cities in the US for quality of life amidst high living costs, according to an analysis by the Ludwig Institute for Shared Economic Prosperity (LISEP). The report ranks America’s 50 largest metropolitan areas based on the economic well-being of middle- and working-class residents. Other areas in the top ten include San Francisco, San Jose, Baltimore, Washington DC, Minneapolis, Portland, Milwaukee, Denver, and Salt Lake City. The study reveals that despite being expensive, these cities offer the best living standards due to higher wages that offset the high cost of living. The best-performing cities typically have a more diverse range of jobs across the pay scale.

Key Takeaway: Understanding the economic dynamics of their region and how they affect different income groups can help real estate professionals in Central Texas strategize accordingly, delivering value to their clients, and furthering their career growth.