In 2025, deciding whether to rent or buy in Austin’s affordable neighborhoods depends on your financial goals and lifestyle. Renting is cheaper upfront and offers flexibility, while buying builds equity and long-term value. Here’s what you need to know:

Key Points:

- Renting Costs: South Austin is the cheapest, with 1-bedroom rents averaging $958/month, followed by North Austin ($1,065) and Allandale ($1,125).

- Buying Costs: Windsor Hills and Garrison Park offer affordable homes. A $375,000 home in Windsor Hills costs $2,696–$3,198/month depending on your down payment.

- Equity Growth: Home values in these areas grow about 6% annually, making buying a better long-term investment.

- Hidden Costs: Renting avoids maintenance and taxes but faces annual rent increases. Buying requires higher upfront costs and ongoing expenses like repairs.

Quick Comparison:

| Option | Monthly Cost (1-Bedroom) | Upfront Costs | Flexibility | Equity Growth |

|---|---|---|---|---|

| Renting | $958–$1,125 | $4,800–$7,200 (deposit) | High | None |

| Buying | $2,696–$3,198 (3-bed home) | $7,500–$75,000 (down) | Low | 6% per year |

Bottom Line: Rent for short-term affordability and flexibility. Buy if you’re staying long-term to build wealth and equity.

Best Places to Live in Austin Under $450K

Austin Housing Market Data (April 2025)

The latest data highlights trends in both Austin’s rental and home purchase markets.

Rental Prices

Austin’s rental market shows differences based on unit type and location:

| Unit Type | Average Monthly Rent | YoY Change |

|---|---|---|

| Studio | $1,275 | +3.2% |

| 1-Bedroom | $1,450 | +4.1% |

| 2-Bedroom | $1,850 | +3.8% |

These rates do not include utilities or additional fees.

Home Purchase Prices

Home purchase prices also reflect noticeable changes. Here’s the median pricing by property type:

| Property Type | Median Price | Monthly Change |

|---|---|---|

| Single-Family Home | $425,000 | -0.5% |

| Townhouse | $375,000 | +0.8% |

| Condo | $315,000 | +1.2% |

These figures show slight monthly adjustments as new construction projects continue shaping Austin’s landscape.

Cheapest Austin Neighborhoods to Rent

Exploring Austin’s neighborhoods can help you find rentals that fit your budget.

South Austin Rental Costs

South Austin stands out as a budget-friendly choice for renters, with one-bedroom apartments averaging $958 per month. Here’s a breakdown of typical rental costs:

| Rental Type | Monthly Rent | Square Footage |

|---|---|---|

| Studio | $875 | 450–550 sq ft |

| 1-Bedroom | $958 | 650–750 sq ft |

| 2-Bedroom | $1,275 | 900–1,100 sq ft |

North Austin Rental Costs

North Austin combines affordability with convenience. One-bedroom apartments here average $1,065 per month, making it a great option for renters:

| Rental Type | Monthly Rent | Square Footage |

|---|---|---|

| Studio | $925 | 425–525 sq ft |

| 1-Bedroom | $1,065 | 625–725 sq ft |

| 2-Bedroom | $1,395 | 850–1,000 sq ft |

Allandale Rental Costs

Allandale offers a mix of charm and value, with one-bedroom apartments averaging $1,125 per month. Here’s what you can expect:

| Rental Type | Monthly Rent | Square Footage |

|---|---|---|

| Studio | $995 | 400–500 sq ft |

| 1-Bedroom | $1,125 | 600–700 sq ft |

| 2-Bedroom | $1,450 | 825–975 sq ft |

If you’re looking for help finding a rental that fits your budget, Austin Local Team‘s apartment locating service can simplify the process.

Next, we’ll look at the most affordable neighborhoods for buying a home in Austin.

sbb-itb-4c99469

Cheapest Austin Neighborhoods to Buy

Let’s look at two neighborhoods in Austin that offer some of the most budget-friendly home prices. For buyers searching for affordable options in Austin’s competitive housing market, these areas stand out for their mix of price and community perks.

Windsor Hills Home Prices

Windsor Hills features reasonably priced homes, well-kept properties, and mature landscaping. Its location offers convenient access to major job centers, making it a practical choice for many buyers. Recent updates to local parks and trails have made the neighborhood even more appealing. Compared to renting, Windsor Hills offers strong value for those planning to settle long-term.

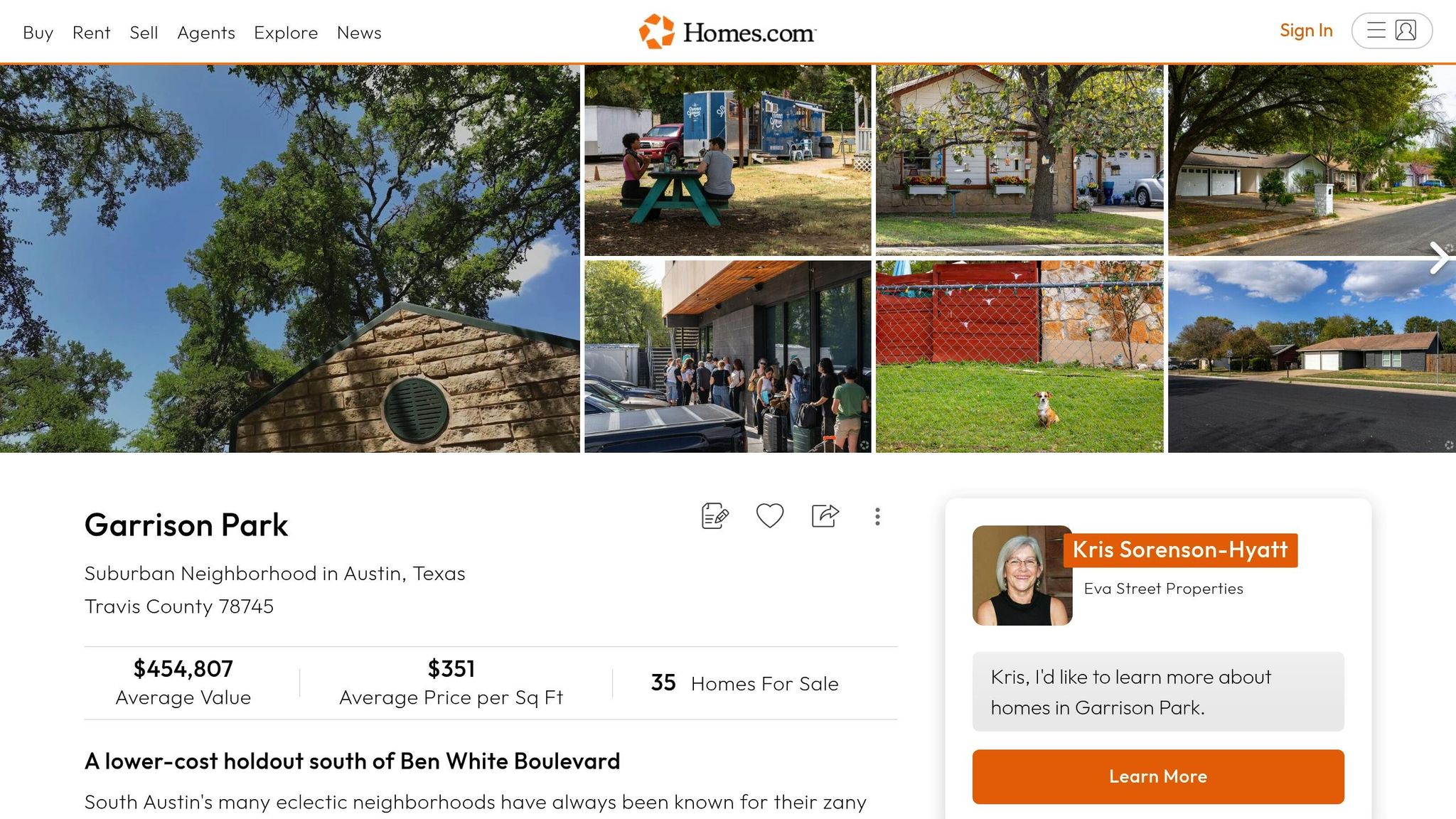

Garrison Park Home Prices

Garrison Park is another affordable option, with home prices below Austin’s median. Its central location makes downtown easily accessible, and the neighborhood boasts plenty of green spaces. These features, combined with steady property value increases, make it a popular choice for first-time buyers and investors alike. This area’s affordability will play a key role in our upcoming rent-versus-buy comparison.

For those exploring Austin’s housing market, the Austin Local Team offers tailored home search services, agent matching, and market analysis to help buyers make informed decisions.

These neighborhoods provide a solid foundation for evaluating whether renting or buying is the better choice in Austin.

Cost Analysis: Renting vs Buying

Monthly Payment Comparison

Here’s a breakdown of monthly costs for a typical 3-bedroom home in Windsor Hills priced at $375,000 with a 30-year fixed mortgage at 6.5% APR. The total monthly cost depends on the down payment:

| Down Payment | Monthly Mortgage | Property Tax | Insurance | Total Monthly Cost |

|---|---|---|---|---|

| 20% ($75,000) | $1,896 | $625 | $175 | $2,696 |

| 10% ($37,500) | $2,133 | $625 | $225 | $2,983 |

| 3.5% ($13,125) | $2,298 | $625 | $275 | $3,198 |

These figures include principal, interest, and Travis County’s property tax rate.

In comparison, a similar 3-bedroom rental averages $2,400 per month, making renting the cheaper option in the short term. However, this is just one part of the equation – long-term financial benefits differ greatly.

Property Value Growth

Homes in these neighborhoods have consistently appreciated at an average rate of 6% per year. For instance, a $375,000 home bought in 2020 could now be worth about $505,000, resulting in $130,000 in equity growth. While renters enjoy lower monthly payments, they miss out on the opportunity to build this equity. According to the Austin Local Team’s market analysis, buyers in these areas generally break even within 5-7 years, factoring in both appreciation and mortgage principal reductions. Renters, on the other hand, avoid upfront costs but don’t benefit from rising property values.

Hidden Costs

Both renting and buying come with additional expenses. Here’s a comparison:

| Expense Category | Buying Costs | Renting Costs |

|---|---|---|

| Upfront Costs | Down payment and closing costs ($7,500–$15,000) | Security deposit and first/last month’s rent ($4,800–$7,200) |

| Maintenance | $3,750–$5,000 annually (1–1.5% of home value) | None (landlord covers it) |

| HOA Fees | $200–$400 annually in most areas | Often included in rent |

| Utilities | All utilities ($250–$350 monthly) | Often partially covered (e.g., water/trash included) |

| Property Taxes | $7,500 annually (as shown above) | None (typically built into rent) |

Homeowners should also plan for unexpected repairs and ongoing maintenance costs. On the other hand, renters face annual rent increases, which have averaged 5% in Austin’s current market. Each choice comes with trade-offs, depending on your financial goals and lifestyle.

Conclusion: Rent or Buy?

Choosing between renting or buying in Austin’s more affordable neighborhoods comes down to your budget and financial goals. Here’s a quick breakdown:

Why Rent?

- Lower upfront costs

- Easier to move when needed

- No maintenance responsibilities

- Short-term affordability with lower monthly payments

Why Buy?

- Build equity with every payment

- Potential for property value growth

- Tax benefits, like mortgage interest deductions

- Long-term stability and wealth-building for those planning to stay

Buying can save money in the long run, but it requires a larger initial investment and ongoing maintenance. The right decision depends on your financial situation and future plans.

For tailored advice, connect with the Austin Local Team. They provide market insights and personalized guidance to help you navigate Austin’s housing market.

Make sure your housing choice fits your budget to set yourself up for financial success.

FAQs

What are the long-term financial advantages of buying a home instead of renting in Austin’s most affordable neighborhoods?

Buying a home in one of Austin’s affordable neighborhoods can offer significant long-term financial benefits compared to renting. While renting may have lower upfront costs, owning a home allows you to build equity over time as property values in Austin continue to rise. This means your home could increase in value, contributing to your overall net worth.

Additionally, fixed-rate mortgages provide predictable monthly payments, unlike rent, which often increases annually. Homeownership may also come with potential tax benefits, such as deductions for mortgage interest and property taxes, which can further enhance your financial situation in the long run. However, it’s essential to consider factors like maintenance costs, property taxes, and your long-term plans when deciding whether to buy or rent.

How do rising rents in Austin impact the decision to rent or buy a home?

Rising rents in Austin can significantly influence the decision to rent or buy a home. With annual rent increases, tenants often face higher monthly expenses over time, making homeownership a potentially more stable and cost-effective option in the long run. Buying a home allows you to lock in a fixed monthly mortgage payment, providing greater financial predictability.

However, the decision depends on factors like your financial situation, how long you plan to stay in Austin, and the upfront costs of buying a home. Comparing average rents to mortgage payments in Austin’s affordable neighborhoods can help you determine which option aligns best with your budget and goals.

What hidden costs should homebuyers in Austin consider before purchasing a property?

When buying a home in Austin, it’s important to account for potential hidden costs beyond the purchase price. These can include property taxes, which vary by neighborhood and property value, homeowners insurance, and maintenance expenses like repairs or landscaping. Additionally, HOA fees may apply in certain communities, and closing costs – covering fees for appraisals, inspections, and title services – can add up to 2-5% of the home’s price.

Planning for these expenses ensures you’re financially prepared for the true cost of homeownership in Austin.